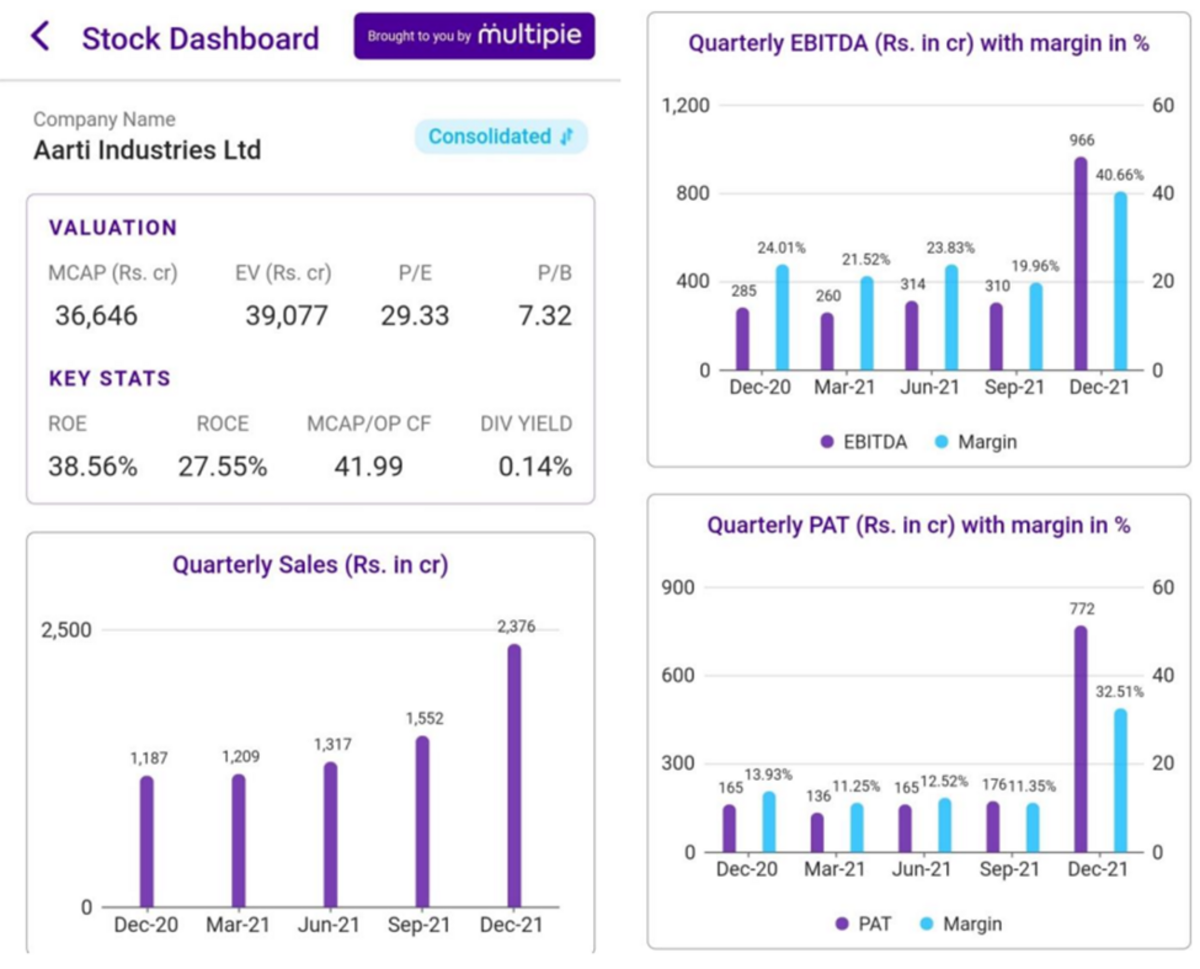

Did you have a look at $Aarti Industries Ltd results 😵😵 It reported ~53% QoQ revenue growth in #Q3FY22 and its EBITDA margin jumped from ~20% to ~40%+ which is a jump of 20%+ in operating margins👀

Revenue expansion is majorly driven by termination fees by a client of 631crs🙄

So the EBITDA margins excluding termination fee is ~17-18%, but management is guiding 25-30% EBITDA in FY24.

In the Last quarter, company did a capex of 312crs and has guided the similar run rate for next quarter. (~300crs)

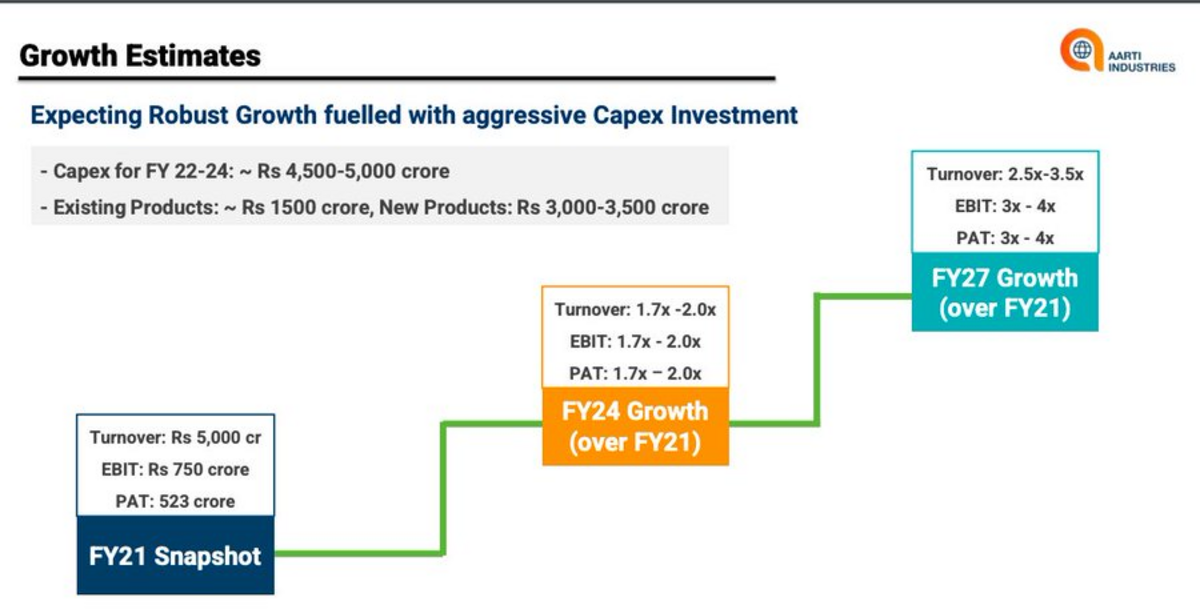

Well if we focus on the guidance, management has been giving very optimistic commentary for the next 5-6 years (check out image 2).

But is it genuine guidance or a narrative building that is happening, what do you think?

Revenue expansion is majorly driven by termination fees by a client of 631crs🙄

So the EBITDA margins excluding termination fee is ~17-18%, but management is guiding 25-30% EBITDA in FY24.

In the Last quarter, company did a capex of 312crs and has guided the similar run rate for next quarter. (~300crs)

Well if we focus on the guidance, management has been giving very optimistic commentary for the next 5-6 years (check out image 2).

But is it genuine guidance or a narrative building that is happening, what do you think?