Some quick notes from RBI annual report for FY22. A thread:

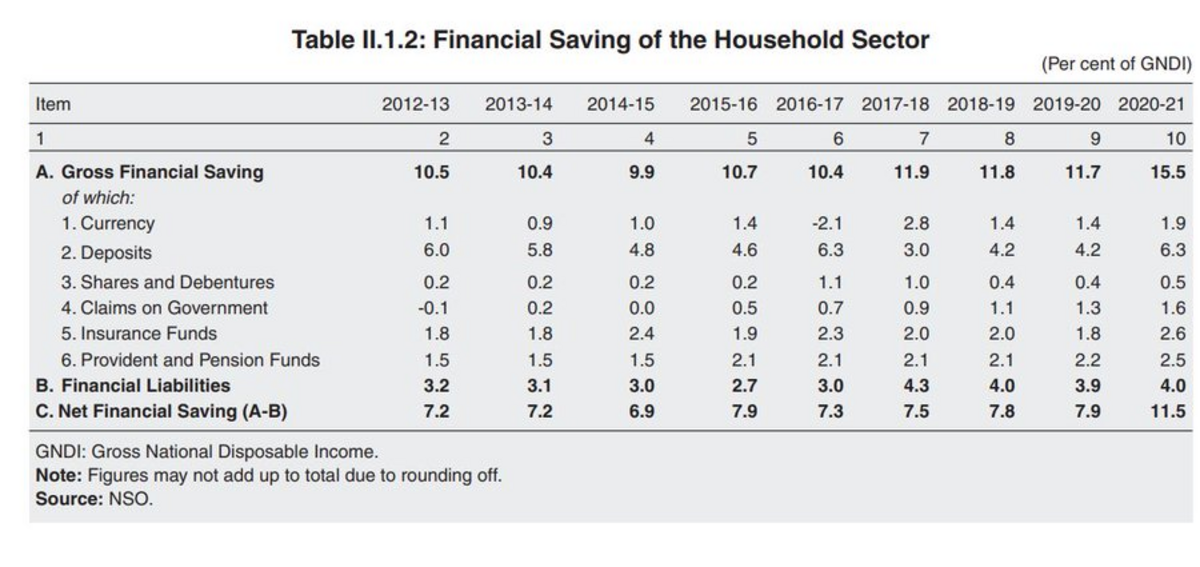

1. Financial savings hit a two-decade high. It is not just currency and bank deposits most financial assets have grown.

1. Financial savings hit a two-decade high. It is not just currency and bank deposits most financial assets have grown.