There's a common saying in the market - Be fearful when others are Greedy and Greedy when others are fearful

It's a market timing statement, but used very loosely

Ever thought, how to know when Investors are Greedy or Fearful...Let's look at 2 data points

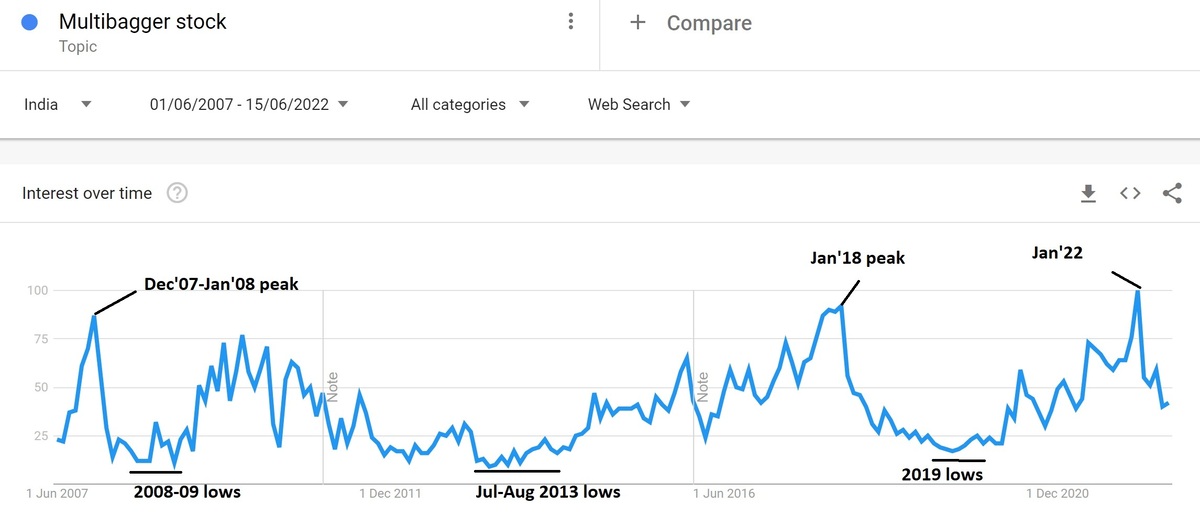

1st - Google Multibagger data chart

This is 1 data we use to understand which zone the market is in or where it is headed

What is it? – It's a graph from Google trends for search term ‘Multibagger stocks’

It's a market timing statement, but used very loosely

Ever thought, how to know when Investors are Greedy or Fearful...Let's look at 2 data points

1st - Google Multibagger data chart

This is 1 data we use to understand which zone the market is in or where it is headed

What is it? – It's a graph from Google trends for search term ‘Multibagger stocks’