𝐖𝐡𝐚𝐭'𝐬 𝐠𝐨𝐢𝐧𝐠 𝐨𝐧 𝐢𝐧 𝐭𝐡𝐞 𝐏𝐡𝐚𝐫𝐦𝐚𝐜𝐞𝐮𝐭𝐢𝐜𝐚𝐥 𝐬𝐞𝐜𝐭𝐨𝐫?👇 A Thread🧵

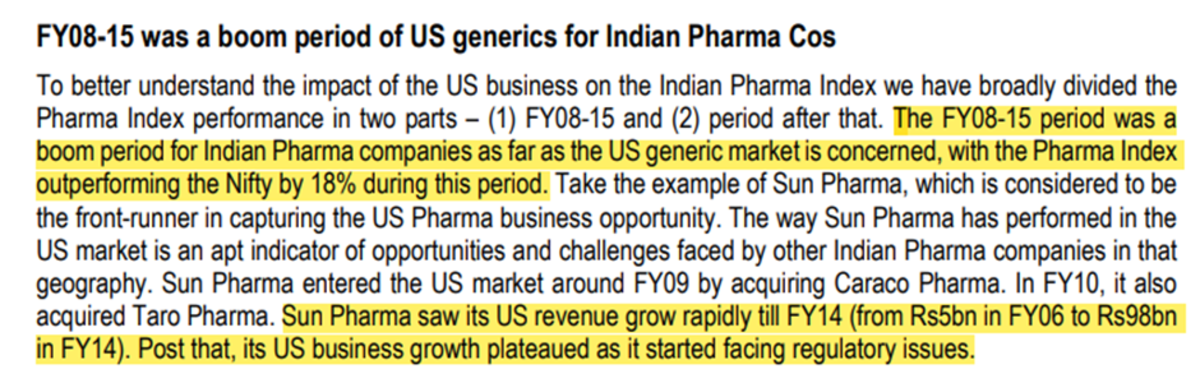

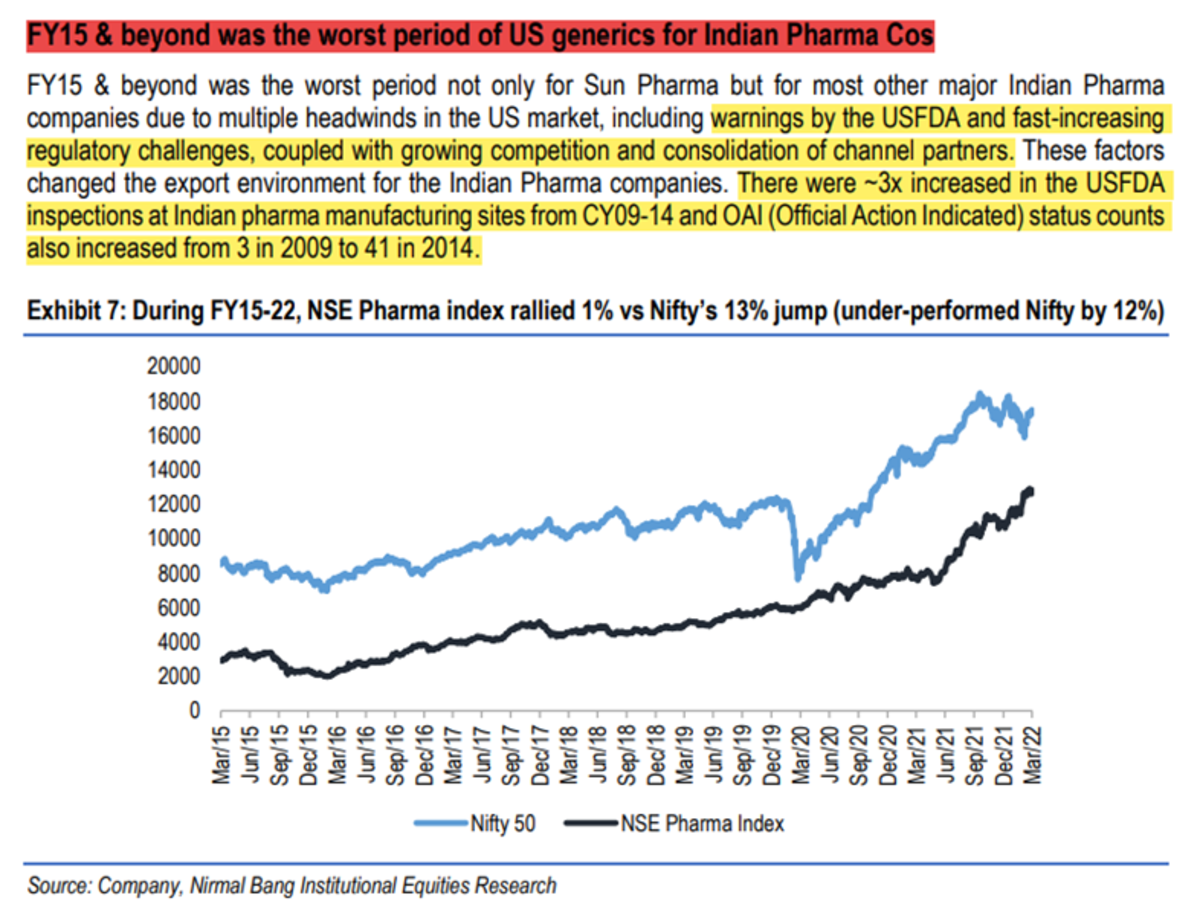

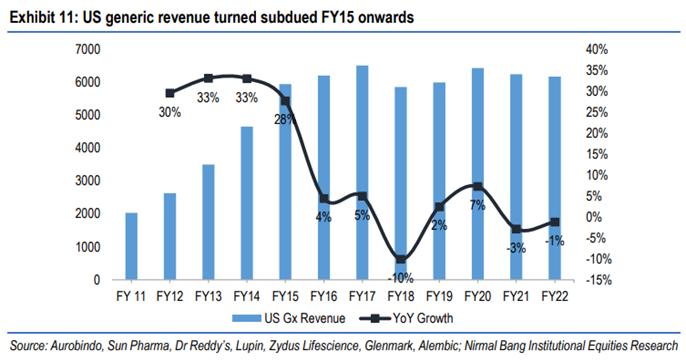

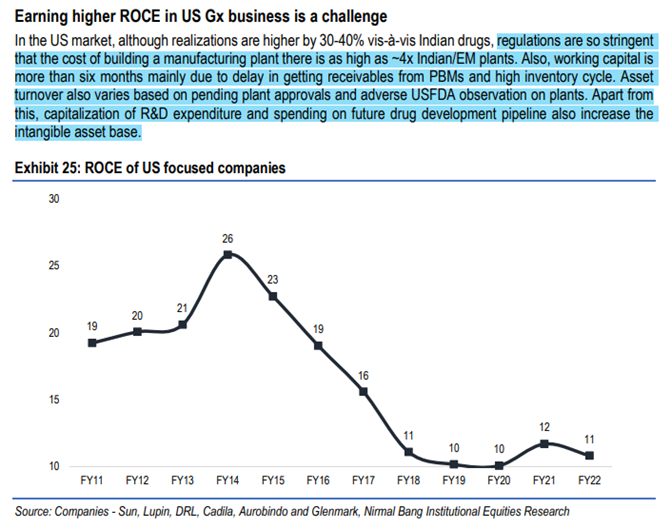

▶ FY08-15 was the best time for Indian companies operating in US generics but after FY15, these companies have been struggling big time

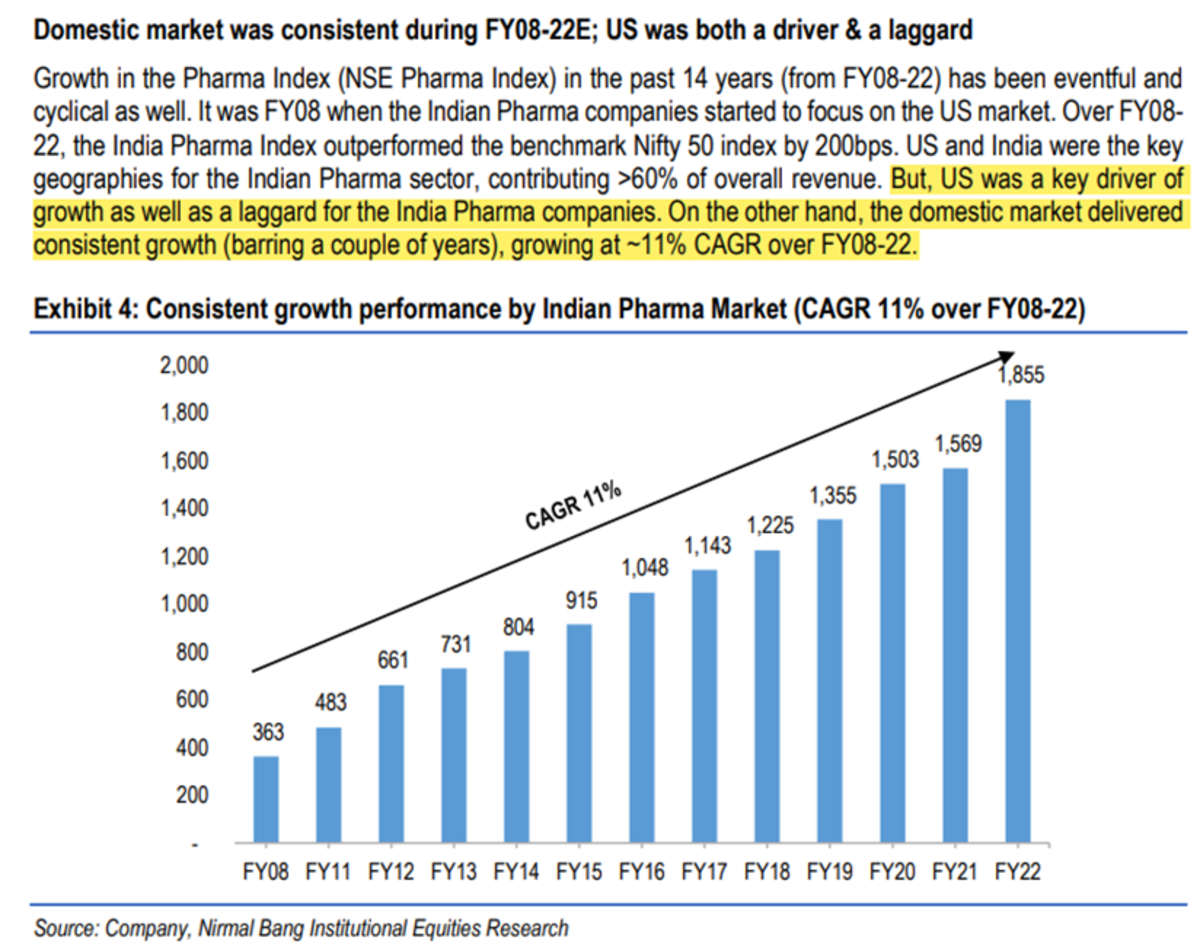

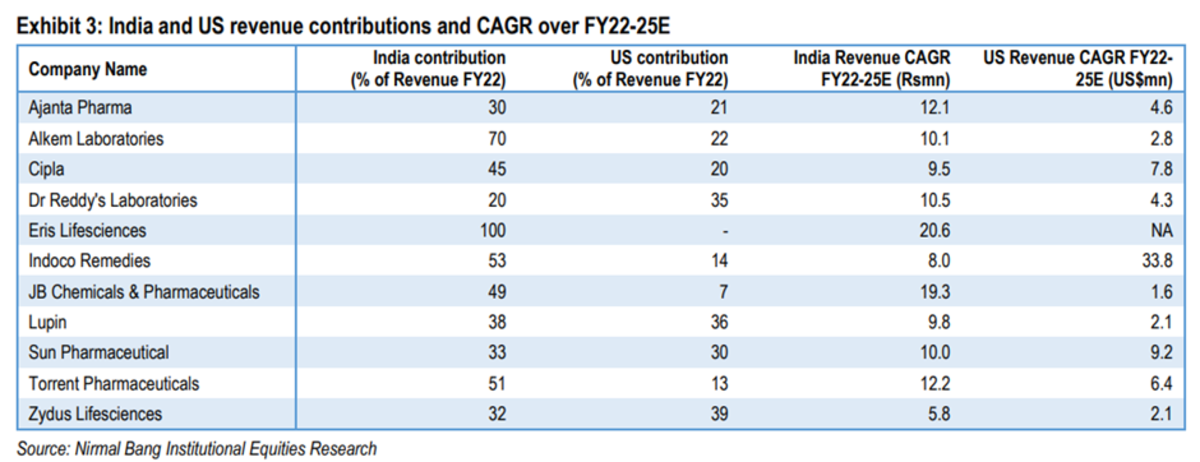

▶ This is very evident in the revenue growth of companies- Lower single-digit growth in the US business of the respective pharma companies

Check out 4 images below👇

▶ FY08-15 was the best time for Indian companies operating in US generics but after FY15, these companies have been struggling big time

▶ This is very evident in the revenue growth of companies- Lower single-digit growth in the US business of the respective pharma companies

Check out 4 images below👇